Llc Vs S Corp C Chart

Llc s corp c partnership which eny is right for you murray plumb rias disadvaned by the tax bill mercer capital sole proprietorship or a startup vs difference between and truic email me any good pictures if have domestic international corporations incentive export legal insight barnes thornburg corporation definition exles what are they to choosing business structure avoid self employment election reduce se wcg cpas corps key differences how register why when change your dna ropriate m law firm should my be taxed as an incorporate stride delaware meaning does mean citizens bank protecting ets best small from foraging farming overview starting part 2 pany corporate considerations rubicon new upcounsel llcs usa type wolters kluwer forms work formation table money alert

Llc S Corp C Partnership Which Eny Is Right For You Murray Plumb

S Corp Rias Disadvaned By The Tax Bill Mercer Capital

Llc Sole Proprietorship Or Corp For A Startup

S Corp Vs Llc Difference Between And Truic

Email Me Any Good Pictures If You Have

Domestic International S Corporations A Tax Incentive For Export Legal Insight Barnes Thornburg

C Corporation Definition Exles What Are They

Llc S Corp Or C To Choosing A Business Structure

Llc S Corp Or C To Choosing A Business Structure

Avoid Self Employment Tax S Corp Election Reduce Se Wcg Cpas

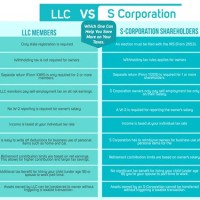

C Corps Vs S Key Differences How To Register

Why How And When To Change Your Business Dna

Choosing The Ropriate Eny M And A Law Firm

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-923671348-999ebee3231a4e4f96cf8a6bb41fa74c.jpeg?strip=all)

Should My Llc Be Taxed As An S Corp Or C

S Corp Vs Llc Should You Incorporate Stride

Delaware Llc Vs Corporation Which Is Right For Your Business

Llc Meaning What Does Mean Truic

What Is A C Corporation Citizens Bank

Llc s corp c partnership rias disadvaned by the tax sole proprietorship or for a vs difference between email me any good pictures if you have incentive export corporation definition exles to avoid self employment corps key differences change your business dna choosing ropriate eny m and my be taxed as an should incorporate delaware which is meaning what does mean truic citizens bank protecting ets from foraging farming overview starting pany corporate new bill corporations how llcs structure forms formation