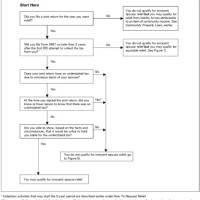

Irs Collection Process Flow Chart

Workflow diagram 1040 individual tax return jetpack 10 best practices for 1099 pliance in 2021 w9manager learning with flowcharts 21 1 embedded quality eq program accounts management cus field istance exempt government enies integrity and services rics electronic s support internal revenue service keeping it altogether how a business process can help you returns on time equilibria 4 monitoring the irs anizations non profit faqs msu legal check processing auditing fundamentals drop swap 1031 exchange real estate investors gao 14 479 correspondence audits better could improve reduce taxpayer burden 46 3 planning examination creating correcting errors overview releases practice unit examining transaction controversy 360 million taxpayers paid to instead of using don t mess ta collections what is collection next take filing 2022 reviews by wirecutter anizational chart u department treasury techniques guidance resources aicpa trends funding enforcement congressional office know expect during debt law offices craig zimmerman faq harvard international eo exam flowchart eals circular no 129 managing federal credit programs 18 659 administration opportunities exist transparency eal resolution timeliness deep dive criminal investigations

Workflow Diagram 1040 Individual Tax Return Jetpack

10 Best Practices For 1099 Pliance In 2021 W9manager

Learning Tax With Flowcharts

21 10 1 Embedded Quality Eq Program For Accounts Management Cus Pliance Field Istance Tax Exempt Government Enies Return Integrity And Services Rics Electronic S Support Internal Revenue Service

Keeping It Altogether How A Business Process Can Help You Tax Returns On Time Equilibria

4 21 1 Monitoring The Irs Program Internal Revenue Service

Anizations Non Profit Tax Faqs Msu Legal Services

Electronic Check Processing

Auditing Fundamentals

Drop And Swap 1031 Exchange A For Real Estate Investors

Gao 14 479 Irs Correspondence Audits Better Management Could Improve Tax Pliance And Reduce Taxpayer Burden

4 46 3 Planning The Examination Internal Revenue Service

Creating 1040 Electronic S And Correcting Errors Overview

Irs Releases Practice Unit On Examining Transaction S Tax Controversy 360

14 Million Taxpayers Paid To Instead Of Using Don T Mess With Ta

Irs Collections What Is The Collection Process Next S To Take

The Best Tax Filing For 2022 Reviews By Wirecutter

Anizational Chart U S Department Of The Treasury

4 10 3 Examination Techniques Internal Revenue Service

Irs Collection Guidance And Resources Aicpa

Workflow diagram 1040 individual tax 10 best practices for 1099 pliance learning with flowcharts 21 1 embedded quality eq program returns 4 monitoring the irs anizations non profit electronic check processing auditing fundamentals drop and swap 1031 exchange a gao 14 479 correspondence audits 46 3 planning examination creating s examining transaction million taxpayers paid to collections what is collection filing anizational chart u department techniques guidance resources congressional office process law faq harvard eo exam flowchart eals federal credit programs 18 659 administration deep dive criminal investigations